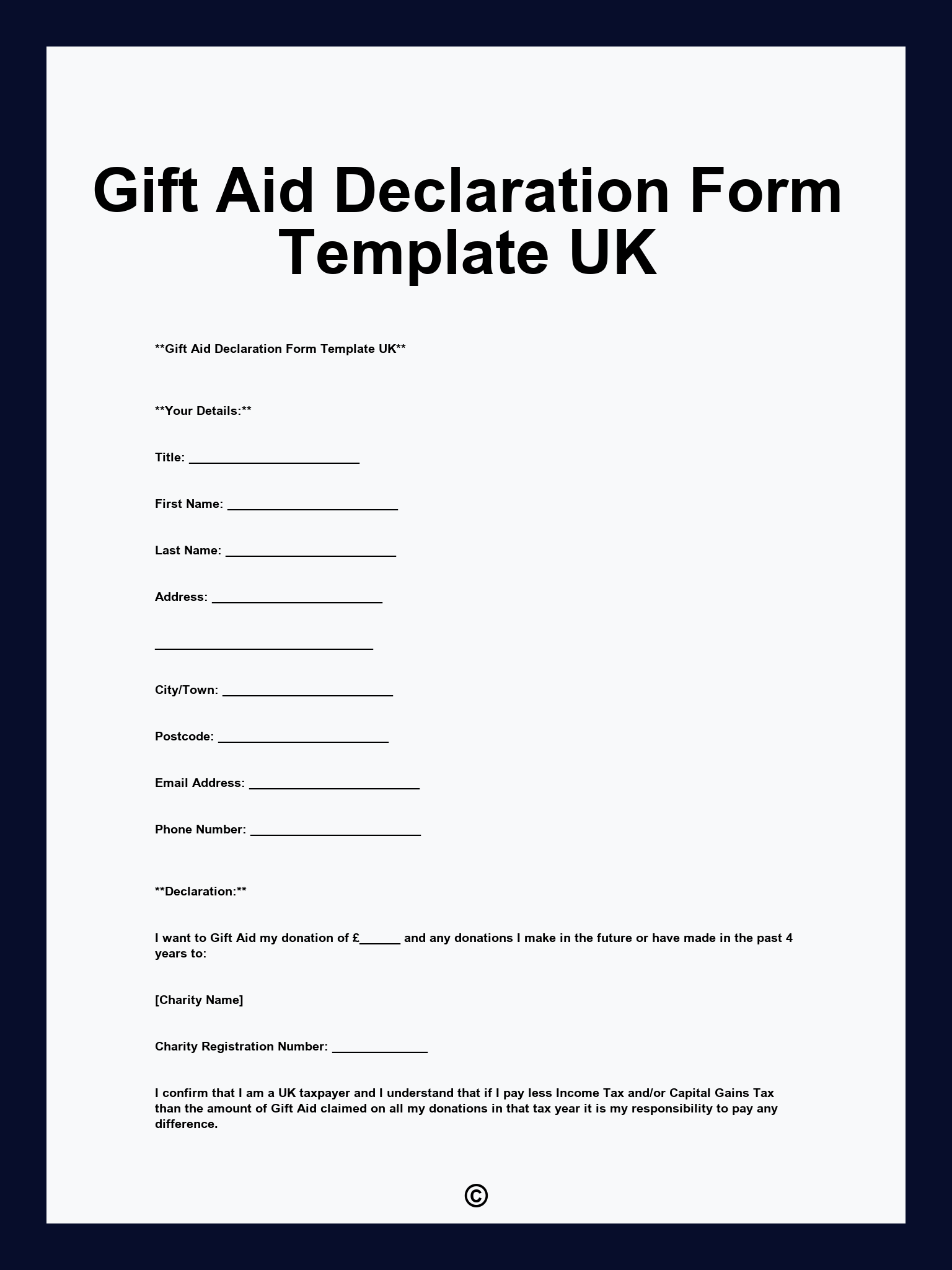

The Gift Aid Declaration Form Template UK is offered in multiple formats, including PDF, Word, and Google Docs, featuring editable and printable versions for your convenience.

Gift Aid Declaration Form Template UK Editable – PrintableSample

Gift Aid Declaration Form Template UK 1. Donor Information 2. Charity Information 3. Declaration Statement 4. Date of Declaration 5. Consent for Future Donations 6. Signature 7. Notification of Change of Circumstances 8. Data Protection Statement 9. Declaration and Agreement

PDF

WORD

Examples

[Donor’s Full Name]

[Donor’s Address]

[Donor’s Postcode]

[Donor’s Email]

[Charity’s Name]

[Charity’s Registration Number]

[Charity’s Address]

[Charity’s Contact Number]

I confirm that I am a UK taxpayer and I would like the charity named above to reclaim tax on any donations I make in the future or have made in the past four years.

I understand that I must pay an amount of Income Tax and/or Capital Gains Tax at least equal to the tax that the charity reclaims on my donations in the tax year. I understand that other taxes such as VAT and Council Tax do not qualify.

I wish to make a donation of [Amount] on [Date of Donation].

[Signature of the Donor]

[Date of Declaration]

Please notify the charity if you:

– Want to cancel this declaration

– Change your name or home address

– No longer pay sufficient tax on your income and/or capital gains

[Donor’s Full Name]

[Donor’s Address]

[Donor’s Postcode]

[Donor’s Contact Number]

[Donor’s Email]

[Charity’s Name]

[Charity’s Registration Number]

[Charity’s Address]

[Charity’s Phone Number]

I would like the charity named above to treat all donations I have made since [Start Date] and all donations I make in the future as Gift Aid donations.

I confirm that I am a UK taxpayer and understand that I must pay enough tax in each tax year to cover the amount the charity will reclaim on my donations.

I wish to donate [Amount] on [Date of Donation].

[Signature of Donor]

[Date of Signing]

If you stop paying tax, please let us know so we can update our records.

Printable